Which Of The Following Is Not A Payment Method Used For International Trade?

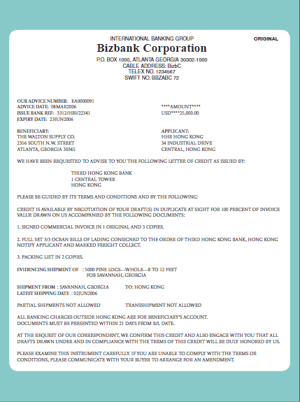

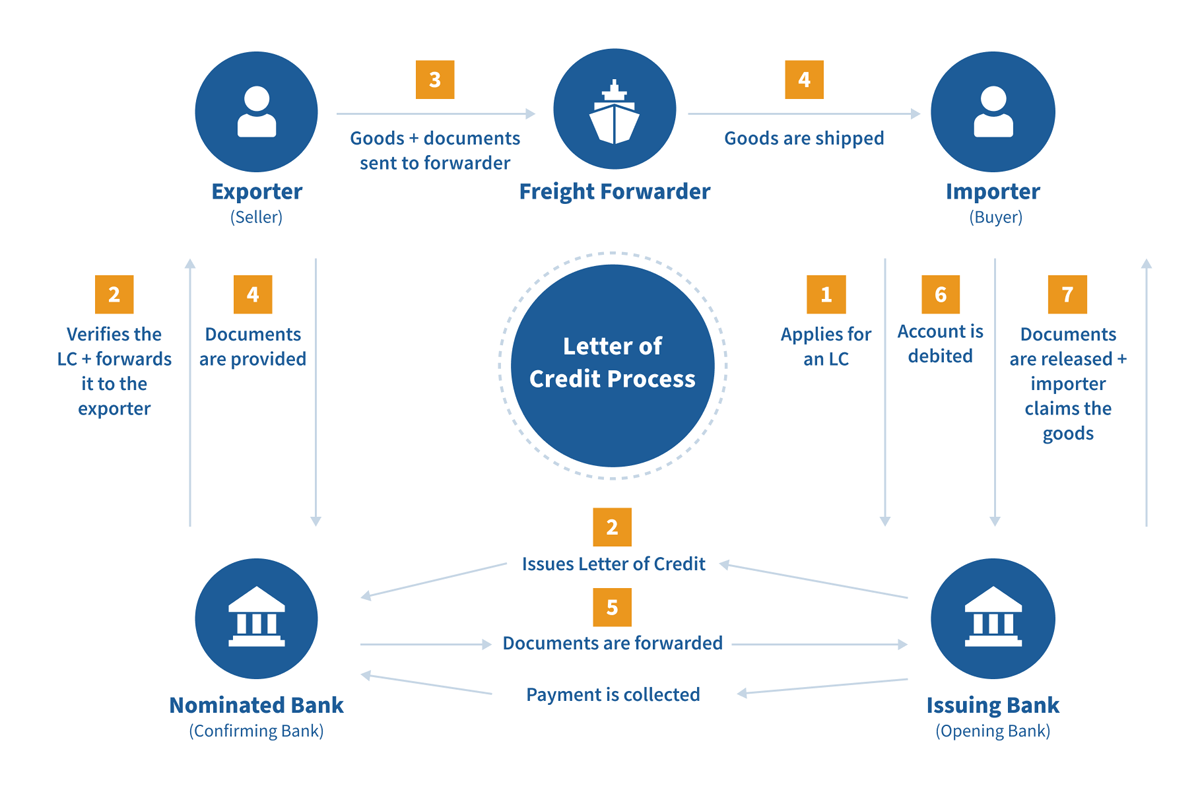

One of the most important considerations when it comes to international trade is how y'all are going to get paid for your exports. While relying on greenbacks up forepart may eliminate the risk of non-payment, it limits your universe of potential customers every bit information technology tin can crusade cash menstruum and other problems for buyers. There are five master methods of payment in international trade that range from most to least secure: cash in advance, letter of credit, documentary collection or draft, open business relationship and assignment. Of class, the about secure method for the exporter is the least secure for the importer and vice versa. The key is to strike the right balance for both sides. This article focuses on letters of credit. A letter of credit, also referred to every bit a documentary credit, is a contractual agreement whereby the issuing banking concern (importer'south bank), acting on behalf of the client (the importer or buyer), promises to brand payment to the beneficiary or exporter against the receipt of complying stipulated documents. The issuing bank volition typically utilise intermediary banks to facilitate the transaction and brand payment to the exporter. The LC is a split contract from the sales contract on which information technology is based; therefore, banks are non concerned with the quality of the underlying goods or whether each party fulfills the terms of the sales contract. The bank's obligation to pay is solely conditioned upon the seller's compliance with the terms and conditions of the LC. In LC transactions, banks deal in documents merely, non goods. LCs can be arranged easily for onetime transactions betwixt the exporter and importer, or used for an ongoing series of transactions. A letter of credit may be irrevocable, which means that it cannot change unless both parties agree; or, it can be revocable, in which example either party may unilaterally make changes. Unless the conditions of the LC land otherwise, information technology is always irrevocable, which means the certificate may not be changed or canceled unless the importer, banks and exporter concord. A revocable LC is inadvisable, as it carries many risks for the exporter. LCs are one of the most versatile and secure instruments bachelor to international traders. Since LCs are credit instruments, the importer's credit with their depository financial institution is used to obtain an LC. The importer pays the bank a fee to render this service. An LC is useful when reliable credit information well-nigh a strange buyer is difficult to obtain or if the foreign buyer'south credit is unacceptable, but the exporter is satisfied with the creditworthiness of the importer'due south bank. This method also protects the importer because the documents required to trigger payment provide evidence that goods accept been shipped equally agreed. Withal, considering LCs open up upwardly the potential for discrepancies, which may negate payment to the exporter, documents should exist prepared by trained professionals. Discrepant documents—literally not having an "i dotted and t crossed"—may negate the bank'due south payment obligation. That'south why many export companies utilize export documentation and compliance software to ensure their export paperwork is accurate and complete. A greater caste of protection is afforded to the exporter when an LC issued by a foreign bank (the importer'due south issuing banking concern) is confirmed by a U.Due south. bank. The exporter asks its customer to have the issuing depository financial institution authorize a banking company in the exporter's state to confirm (this bank is typically the advising bank, which then becomes the confirming bank). Confirmation ways that the U.Southward. bank adds its engagement to pay the exporter to that of the strange banking company. If an LC is non confirmed, the exporter is subject area to the payment gamble of the foreign bank and the political risk of the importing country. Exporters should consider getting confirmed LCs if they are concerned virtually the credit continuing of the foreign bank or when they are operating in a high-hazard market where political upheaval, economic collapse, devaluation or exchange controls could put the payment at risk. Exporters should also consider getting confirmed LCs when importers are request for extended payment terms. In that location are typically vii steps that occur in order to get paid using a letter of credit: While an LC commonly involves the exporter, importer and both parties' banks, these iv principals can exist referred to by unlike names: Letters of credit can take many forms. When an LC is made transferable, the payment obligation under the original LC can be transferred to one or more than 2nd beneficiaries. With a revolving LC, the issuing bank restores the credit to its original amount each time it is fatigued downwards. A standby LC is not intended to serve equally the means of payment for goods but can exist drawn in the outcome of a contractual default, including the failure of an importer to pay invoices when due. Similarly, standby LCs are often posted past exporters in favor of an importer because they can serve as bid bonds, performance bonds and advance payment guarantees. In improver, standby LCs are often used as counter guarantees confronting the provision of downwardly payments and progress payments on the role of foreign buyers. If you're considering letters of credit for your exports, go on these things in mind: Similar what you read? Subscribe today to the International Trade Weblog to get the latest news and tips for exporters and importers delivered to your inbox. This commodity is taken in large part from the Merchandise Finance Guide: A Quick Reference for U.Due south. Exporters, which you can download for free by clicking the link below.

What Is a Letter of Credit in Global Trade?

Understanding a Letter of the alphabet of Credit

Understanding a Letter of the alphabet of CreditThe Advantages of a Alphabetic character of Credit

Confirmed Letter of the alphabet of Credit

The Alphabetic character of Credit Process

Parties to a Letter of the alphabet of Credit

Special Letters of Credit

Tips For Exporters on Using Letters of Credit

Which Of The Following Is Not A Payment Method Used For International Trade?,

Source: https://www.shippingsolutions.com/blog/methods-of-payment-in-international-trade-letters-of-credit

Posted by: williamsyestan73.blogspot.com

0 Response to "Which Of The Following Is Not A Payment Method Used For International Trade?"

Post a Comment